Why traders lose money to predictable brain quirks

If your P&L ever felt like it was fighting an invisible current, you’ve met your cognitive biases. Two of the most expensive for day traders are loss aversion and recency bias. Loss aversion comes from prospect theory: we feel the pain of losing more intensely than we feel the pleasure of an equal-sized gain, so we make different choices when outcomes are framed as avoid a loss versus lock a gain.

That tilt shows up even when we know the math. Kahneman and Tversky formalized this in 1979, and large-scale replications decades later still find the pattern across countries and contexts. For intraday decisions, where dozens of small choices compound quickly, those tiny tilts accumulate into very real slippage in execution and risk control. Knowing the names matters less than recognizing that these are reliable, testable tendencies in human judgment that you can plan around instead of trying to outmuscle with willpower.

Loss aversion on the desk: selling winners, sitting on losers

Loss aversion doesn’t just nudge you, it reshapes your trade management. It’s the engine behind the disposition effect: the tendency to sell winners too early and hold losers too long. In retail brokerage data, researchers repeatedly find that the stocks individual investors buy underperform the ones they sell, and that higher turnover tends to coincide with worse performance – classic signatures of cutting gains short while giving losses too much leash. Translate that to a five-minute chart and you get premature profit-taking after a small move in your favor, then stubbornness when price tags your stop.

The bias feels rational in the moment (‘I’ll just wait for a bounce’), but under the hood it’s your brain overweighting the sting of booking a red trade. Protecting yourself means pushing trade exits back to your plan, target and stop set when you were calm and then reviewing whether your edge actually paid more when you let winners run and cut losers on schedule.

Recency bias: last trade syndrome

Recency bias is simpler to spot. We overweight the most recent information. In psychology, the recency effect describes how items presented last are recalled best, and the same mechanism leaks into judgment. Yesterday’s gap-and-go feels like tomorrow’s baseline, and the last three losses feel like proof your setup stopped working. In fast markets that constantly change tempo, this bias pulls you away from base rates and toward whatever just happened on your screen.

You see it when traders abandon a strategy after a small losing streak or size up recklessly after two quick wins. The fix isn’t pretending memory doesn’t work this way, it’s building an external memory that keeps longer context visible so the last few bars don’t define your risk decisions. That starts with writing things down and reviewing systematically instead of deciding position size from a mood.

Why journaling is an antidote: turning instincts into data

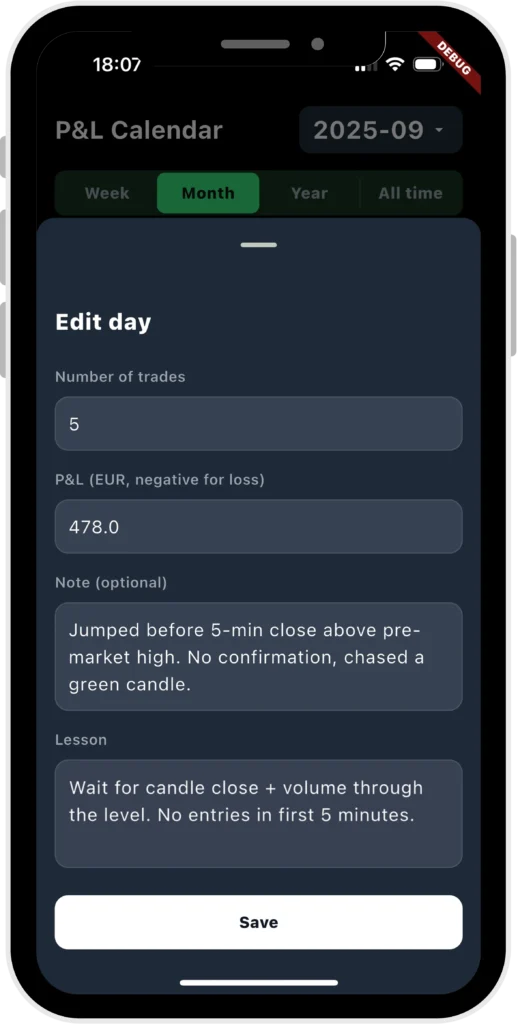

Journaling works because it forces metacognition – thinking about your thinking, before and after the trade. On the front end, a written plan slows fast intuitive impulses just long enough for deliberate checks to catch obvious bias-driven errors. On the back end, structured notes let you analyze outcomes by setup and context instead of by vibe.

Research on decision debiasing repeatedly points to metacognitive prompts and checklists as useful brakes on common errors, and studies in adjacent fields show that making your reasoning explicit improves later judgment and emotion regulation. A trading journal is just a domain-specific version of that: it externalizes memory, it creates accountability to your own rules, and it builds a dataset that dilutes recency by showing the broader distribution of results. Over time, the habit reduces the gap between what you intended to do and what you actually executed when the tape sped up.

What to capture so the biases actually shrink

A journal doesn’t need poetic essays, it needs consistent fields that turn bias into visible patterns. Record the setup name, pre-defined entry, stop and target, position size and intended risk in currency or R, the actual exit and R-multiple and a sentence on why you deviated if you did. Tag emotions briefly (chased, revenge, hesitated).

During weekly review, sort by setup and session to compare realized win rate, payoff ratio, and expectancy against your plan. That comparison is where loss aversion reveals itself as a cluster of early exits on green trades and widened stops on red ones. It’s where recency bias shows up as size inflation after a win streak or abandonment after a small skid. Many practitioner resources advocate journals precisely because this structure nudges you back to base rates and pre-commitment instead of letting last trade feelings steer. The point isn’t a perfect diary, it’s a lightweight system that keeps you honest when your brain’s shortcuts would rather improvise.

Rules you’ll actually keep

Biases don’t disappear, they get managed. The practical loop looks like this: plan your trade in writing, execute to the plan, and review with numbers that matter for your style. If your journal shows a pattern of cutting winners, experiment with mechanical partials that move to break-even but keep a runner at the original target so loss aversion can’t shrink your average win.

If recency is tugging you around, cap your size changes to a preset step and require a full-week review before turning a cold streak into a strategy overhaul. The longer you keep this loop, the more your identity shifts from “I feel good about this trade” to “My data says this setup pays X when I follow the rules.” That shift from instinct to evidence is how day traders bend predictable human quirks back in their favor.